AVATrade Islamic Account

AvaTrade is a globally recognized forex broker, providing retail and institutional clients with a wide range of trading services. Established in 2006 in Dublin, Ireland, AvaTrade forex has since expanded its operations to various parts of the world, demonstrating its commitment to providing a user-friendly, reliable, and innovative trading environment. The platform offers over 250 financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. AvaTrade is licensed and regulated in several jurisdictions, including the European Union, Australia, Japan, and South Africa, ensuring a high level of security and trust for its clients. Constantly evolving to meet the needs of its users, AvaTrade broker stands as a leader in the forex brokerage industry. We will learn more about the broker’s special feature, the AvaTrade Islamic Account in this review.

What is an AvaTrade Islamic Account?

An AvaTrade Islamic Account is a special type of trading account offered by AvaTrade, a globally recognized online brokerage firm. This account is designed to comply with Sharia law, which prohibits Muslims from earning interest, a concept known as “Riba”. Therefore, unlike conventional trading accounts, Islamic accounts on AvaTrade forex do not incur or give out interest charges on overnight positions, also known as swap or rollover fees. This makes it a suitable option for Muslim traders who want to participate in online trading while adhering to their religious principles.

AvaTrade Account Types

- Retail Account: This type of account is suitable for beginners or casual traders. The retail account offers a range of trading instruments such as Forex, indices, stocks, commodities, and cryptocurrencies. It allows traders to start trading with a minimum deposit and provides access to educational resources and customer support.

- Standard Account: A standard account is a traditional AvaTrade account that offers access to all the trading instruments available on the platform. It requires a higher minimum deposit compared to the retail account but offers tighter spreads. Standard account holders can also access AvaTrade’s educational resources and customer support.

- Spread Betting Account: This type of account is available to traders in the UK and Ireland. Spread betting involves betting on the direction of a particular market without owning the underlying asset. Profits from spread betting are tax-free in the UK and Ireland. AvaTrade broker provides spread betting on Forex, indices, stocks, and commodities.

- Professional Account: The professional account is designed for experienced and skilled traders. It offers higher leverage compared to the standard account and provides access to a dedicated account manager. Professional account holders must meet certain criteria, such as sufficient trading activity in the past year and a financial portfolio exceeding €500,000.

- MAM/PAMM Account: The Multi-Account Manager (MAM) and Percentage Allocation Management Module (PAMM) accounts are designed for professional traders and money managers who manage multiple trading accounts. These types of accounts allow the manager to distribute trades among various accounts while maintaining control over account parameters. They also offer real-time reporting of performance and commissions.

AvaTrade Demo Account

The AvaTrade Demo Account provides users with a platform to practice and enhance their trading skills without any risk. This account comes with a virtual balance, allowing users to simulate real trading scenarios in real market conditions. The features of this account are designed to closely mimic a live trading environment, providing access to live buy and sell prices and the ability to trade various instruments including Forex, CFDs, cryptocurrencies, commodities, and indices. It also offers access to AvaTrade’s trading platforms such as the AvaTrade mobile app, MetaTrader 4, and MetaTrader 5. The demo account is ideal for both beginners who want to learn how to trade and experienced traders who want to test new strategies.

Available Assets with an AvaTrade Islamic Account

An AvaTrade Islamic Account allows clients to trade a variety of financial instruments while adhering to Sharia law. This includes:

- Forex: This is a global marketplace for trading national currencies against one another. Forex trading is a popular choice amongst traders due to its high liquidity and 24/7 schedule.

- Stocks: This involves buying, selling, and holding shares of publicly traded companies. Stocks are a popular choice for both short-term traders and long-term investors.

- Commodities: Traders can speculate on the price of various raw materials such as oil, gold, natural gas, and agricultural products. Commodities trading can be a good way to diversify a portfolio.

- FXOptions: This is a type of derivative financial instrument that gives the holder the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified future date.

- Crypto CFD: This allows traders to speculate on the price of cryptocurrencies like Bitcoin, Ethereum, and Ripple without actually owning the digital asset. Crypto CFDs are leveraged products, meaning traders can open a position for only a fraction of the full value of the trade.

- Indices: These are portfolios of stocks that represent a particular market or a portion of it. Each index has its own calculation methodology and is typically expressed in terms of a change from a base value.

- ETFs: Exchange-Traded Funds are investment funds traded on stock exchanges, much like individual stocks. They are designed to track the performance of a specific index, sector, commodity, or asset class.

- Bonds: These are fixed-income instruments that represent a loan made by an investor to a borrower (typically corporate or governmental). Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations.

AvaTrade Deposit Options

AvaTrade offers various options for depositing funds into your trading account.

- Credit/Debit Cards: AvaTrade accepts both credit and debit card deposits. This is one of the quickest and most convenient ways to fund your account. This option allows immediate transfers directly from your bank account. They accept a variety of cards including Visa, Mastercard, and others. Please note that there may be certain limits imposed on the amount that can be deposited via credit or debit cards.

- E-Payments: E-payments are another efficient way to deposit funds into your AvaTrade account. This deposit option includes various online payment platforms such as PayPal, Skrill, Neteller, and others. These platforms are known for their speed and security, ensuring that your funds are transferred safely to your trading account. However, the availability of these options may vary depending on your location.

- Wire Transfer: If you prefer a more traditional method, AvaTrade also accepts deposits through wire transfer. This involves transferring money directly from your bank account to your trading account. While this method may take slightly longer than the others due to bank processing times, it is often preferred by traders who wish to deposit larger amounts. Wire transfers are known for their reliability and can be done from virtually any bank around the world.

Please note that AvaTrade does not charge any deposit fees, regardless of the method you choose. However, your bank or e-payment provider may charge a fee on their end. The AvaTrade minimum deposit amount relies on your account’s base currency and the deposit method you use.

AvaTrade Withdrawal Options

AvaTrade offers various options for depositing funds into your trading account.

- Credit/Debit Cards: AvaTrade accepts both credit and debit card deposits. This is one of the quickest and most convenient ways to fund your account. This option allows immediate transfers directly from your bank account. They accept a variety of cards including Visa, Mastercard, and others. Please note that there may be certain limits imposed on the amount that can be deposited via credit or debit cards.

- E-Payments: E-payments are another efficient way to deposit funds into your AvaTrade account. This deposit option includes various online payment platforms such as PayPal, Skrill, Neteller, and others. These platforms are known for their speed and security, ensuring that your funds are transferred safely to your trading account. However, the availability of these options may vary depending on your location.

- Wire Transfer: If you prefer a more traditional method, AvaTrade also accepts deposits through wire transfer. This involves transferring money directly from your bank account to your trading account. While this method may take slightly longer than the others due to bank processing times, it is often preferred by traders who wish to deposit larger amounts. Wire transfers are known for their reliability and can be done from virtually any bank around the world.

Please note that AvaTrade does not charge any deposit fees, regardless of the method you choose. However, your bank or e-payment provider may charge a fee on their end. The AvaTrade minimum deposit amount relies on your account’s base currency and the deposit method you use.

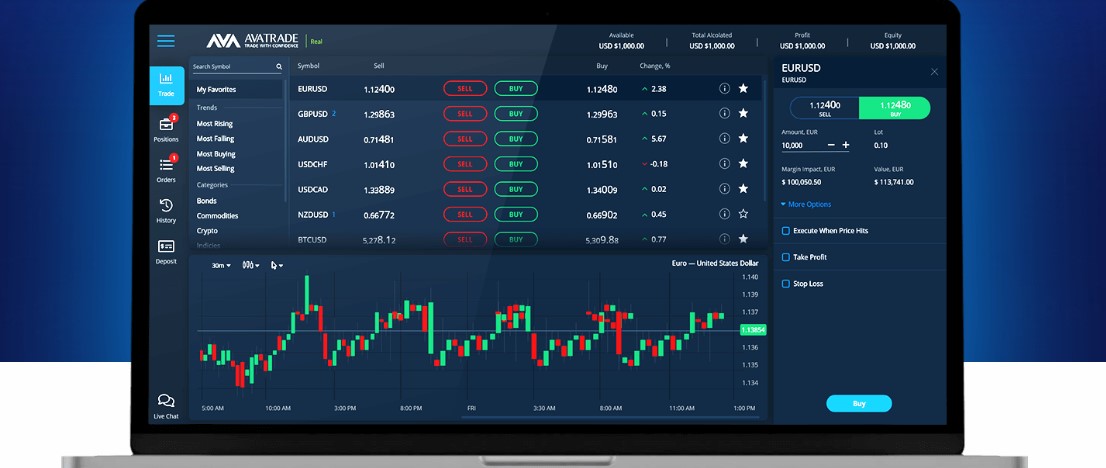

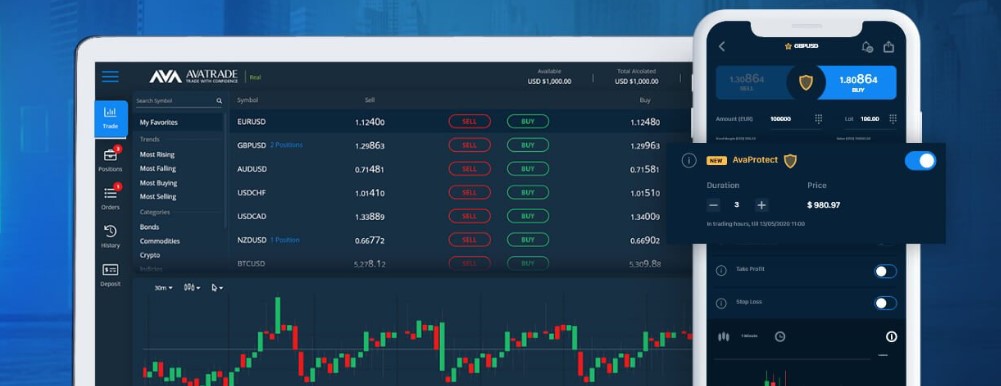

AvaTrade Trading Platforms

AvaTrade is a well-known online trading platform that offers multiple trading platforms to suit different types of traders.

- WebTrader: This platform is web-based and doesn’t require any download or installation. It allows for direct access to the AvaTrade account from any corner of the world where internet access is available.

- AvaOptions: This platform is designed for trading forex options and it provides a wide range of analytical tools. It also combines spot and options trading all in one platform, which is ideal for those traders who like to use a combination of the two in their strategies.

- AvaTrade App: This is a mobile application available for both iOS and Android users. It allows traders to access their accounts and trade on the go. It offers all the functionalities of the desktop version, including real-time charting and a variety of trading tools.

- Mobile Trading: Aside from the AvaTrade App, AvaTrade also offers a mobile version of the WebTrader platform. This allows for quick and easy access to trading accounts from any mobile device.

- Mac Trading: AvaTrade offers a platform that is fully compatible with Mac operating systems. This platform offers all the features and tools needed for effective online trading.

- MetaTrader 4: Also known as MT4, this is one of the most popular trading platforms in the world. It offers advanced technical analysis, a flexible trading system, and algorithmic trading tools.

- MetaTrader 5: This is an upgraded version of the MT4 platform. It offers additional features such as more technical indicators, a more flexible trading system, and enhanced order management capabilities.

Additional Features

- Automated Trading: AvaTrade offers a feature known as ‘Automated Trading’. This feature enables traders to set specific criteria for trades, which the system will then execute automatically once these conditions are met. This means you can trade 24/7, even when you’re not online or available. This feature is particularly useful for those who may not have time to constantly monitor the markets or for those who want to take some of the emotion out of their trading decisions.

- AvaSocial: AvaSocial is another unique feature offered by AvaTrade platform. This feature allows traders to follow, learn, and even copy trades from other successful traders. This social trading feature is beneficial for both beginners who can learn from experienced traders and for experienced traders who can earn additional income by allowing others to follow their trades. AvaSocial also provides a platform for traders to interact, discuss strategies, and share insights.

- DupliTrade: DupliTrade is an automated trading feature that allows you to automatically copy the trades of experienced traders in real time. This feature is particularly beneficial for novice traders as it allows them to replicate the strategies of successful traders and hopefully replicate their success as well. With DupliTrade, you can review the performance history of different strategy providers to decide whose trades you want to follow.

In conclusion, AvaTrade broker offers a range of additional features that are designed to simplify the trading process and increase the chances of success for their clients. Whether you are a beginner or an experienced trader, these features provide tools and resources to help you make more informed trading decisions.

AvaTrade Trader’s Tools

These are a suite of tools offered by AvaTrade, a leading forex and CFD broker, to enhance the trading experience of its users. The tools are designed to assist traders in making more informed decisions and to maximize their potential returns.

- AvaProtect: This is a unique risk management tool offered by AvaTrade. It allows traders to protect their trades against all types of market risks for a defined period. If the market moves against the trade during the protected period, AvaTrade will reimburse the trader for the loss.

- Trading Signals: These are suggestions or alerts generated by advanced algorithms or experienced professional traders. They provide information on potential trading opportunities in the market. AvaTrade provides access to trading signals to help its users make effective trading decisions.

- Economic Calculator: This tool allows traders to calculate and understand the potential impact of macroeconomic events on their trades. It can help traders plan their strategies according to the anticipated market movements.

- Trading Calculator: This is a handy tool for traders to calculate their potential profits, losses, and costs associated with their trades. It takes into account factors like leverage, lot size, and opening and closing prices to provide a comprehensive breakdown of the trade.

- Fundamental Analysis: AvaTrade provides resources for fundamental analysis, which involves analyzing economic indicators, industry conditions, and company performance to predict future price movements. This can help traders make long-term investment decisions.

- Technical Analysis: This involves analyzing historical price patterns and market trends using statistical measures and charting tools. AvaTrade provides access to advanced charting tools and indicators for technical analysis, which can help traders identify potential short-term trading opportunities.

Education resources

AvaTrade Forex Academy is an educational platform provided by AvaTrade, a leading online forex and CFD broker. This academy offers a wide range of learning resources for both beginners and experienced traders.

The academy covers various topics such as trading strategies, market analysis, risk management, and trading psychology. It also provides insights into the different types of financial instruments that can be traded, like forex, stocks, commodities, indices, and cryptocurrencies.

The AvaTrade Forex Academy uses different learning formats, including video tutorials, webinars, eBooks, and one-on-one training sessions. These resources aim to equip traders with the necessary skills and knowledge they need to navigate the volatile world of forex trading successfully.

Furthermore, the academy also offers a demo account feature. This allows users to practice their trading strategies in a risk-free environment before they start live trading.

In addition to its educational resources, AvaTrade Forex Academy also provides up-to-date market news and analysis to help traders make informed decisions.

Overall, AvaTrade Forex Academy is a comprehensive learning platform for anyone interested in forex trading. Whether you’re a novice trader just starting or an experienced trader looking to enhance your skills, this academy offers valuable resources to help you achieve your trading goals.

AvaTrade Islamic Account Review – Customer Support

- WhatsApp: For customers who prefer to use messaging apps, AvaTrade offers support through WhatsApp. This allows customers to reach out to their support team directly from their smartphones, making it a very convenient option.

- Phone: AvaTrade has a dedicated phone line for customer support. This is a great option for customers who prefer to speak directly with a support representative. The phone support team is trained to help with a range of issues, from technical problems to account queries. Check out the AvaTrade website under “Contact Us”, phone numbers for various countries are listed.

- Live chat: For quick and immediate assistance, AvaTrade offers a live chat feature on their website. This allows customers to chat in real time with a member of their support team. This can be particularly useful for resolving issues quickly or getting immediate answers to questions.

In addition to these options, AvaTrade also offers email support for less urgent queries or issues that may require detailed explanations or attachments. This comprehensive range of support options ensures that AvaTrade customers can always get the help they need, in the way that is most convenient for them.

Is AvaTrade Halal in Islam?

AvaTrade is considered halal in Islam, as it adheres to the principles of Islamic finance. This brokerage platform offers an Islamic trading account, also known as a swap-free account, which complies with the Sharia law. It does not accrue interest or swap fees on overnight positions, which aligns with the Islamic prohibition of Riba (usury or interest). AvaTrade broker also follows the principle of immediate exchange (spot trading) and does not engage in gambling or speculative trading, making it permissible for Muslims. Therefore, AvaTrade is considered a halal trading platform in the Islamic faith.

Is AvaTrade safe to trade with?

AvaTrade is a secure and reliable platform for online trading. It is regulated and overseen by multiple international financial authorities. This means AvaTrade adheres to strict international standards of transparency and fairness, further ensuring the safety and security of its traders. Additionally, client funds are held in segregated accounts for added protection. The platform also utilizes advanced encryption technologies to safeguard users’ personal and financial information. Therefore, AvaTrade platform is considered safe for trading.

AvaTrade review Islamic Account – Conclusion

In conclusion, the AvaTrade Islamic Account is an advantageous option for Muslim traders who wish to engage in online trading, in compliance with Sharia law. The account offers a no-interest, no-rebate policy and allows trading on a wide range of assets, including forex, commodities, and indices. The platform is user-friendly, providing efficient trading tools, educational resources, and 24/7 customer support. Furthermore, AvaTrade is a well-regulated and secure platform, thus ensuring the safety of user funds. However, it’s always suggested that potential users should thoroughly research and consider their financial decisions carefully before proceeding. Overall, the AvaTrade Islamic Account delivers a positive and ethical trading environment.