easyMarkets Islamic Account

Online trading platforms allow you to access CFD markets 24 hours a day and give you access to Forex, commodities, stocks, bonds, ETFs, currency options, and much more. Some traders are engaged in day trading, keeping the position open for a few hours or less. Other traders, however, trade with an intention to hold their trade over one day and hold their position open for more than 24 hours. When you keep a position open overnight, you have to pay a rollover fee. Such rollover fees or interest goes against the principles of Reba Sharia law. For this reason, easyMarkets offer an Islamic account that does not charge any interest while trading and keeps a position open overnight. Learn more about the easyMarkets Islamic account in this article.

easyMarkets Account Types

At easyMarkets, three types of account options are available to cater to various trading needs and budgets.

- Standard Account – This account type is ideal for beginners or those who prefer to trade with a smaller amount of money. The minimum deposit required to open a Standard Account is $10. This type of account offers essential trading tools and features that are suitable for novice traders. However, the processing time and fees may vary depending on the specific transaction.

- Premium Account – This account requires a larger minimum deposit of $1000. The Premium Account is designed for more experienced traders who are willing to invest a larger capital for higher returns. The Premium Account offers more advanced trading tools and features to help traders make more informed decisions. Just like the Standard Account, the processing time and fees may vary depending on the specific transaction.

- VIP Account – A deposit of at least $2500 is needed to open this type of account. This is ideal for high-level traders who are looking to take advantage of the most advanced trading tools and features that easyMarkets has to offer. The VIP Account also provides a more personalized trading experience with a dedicated account manager and other premium services. The processing time and fees for the VIP account may also vary depending on the transaction.

easyMarkets Demo Account

The easyMarkets Demo Account offers a range of features designed to help both novice and experienced traders familiarize themselves with online trading practices. This free-of-charge demo account provides users with access to real market conditions without any risk, allowing them to practice trading strategies and gain confidence before transitioning to live trading.

Users can trade over 200+ global markets including forex, commodities, indices, and cryptocurrencies. The demo account also provides access to easyMarkets’ innovative trading tools like dealCancellation, Freeze Rate, and Inside Viewer. Furthermore, it offers educational resources and customer support to assist users in understanding the trading platform and strategies.

easyMarkets Islamic Account

EasyMarkets Islamic Account features are designed to accommodate the specific needs of Muslim traders. These accounts are fully compliant with Sharia law, which prohibits the acceptance of interest or “riba”. EasyMarkets Islamic account does not have swap or rollover charges on overnight positions, thus ensuring that no interest is paid or received. This feature makes it suitable and appealing to Muslim traders who need to ensure their trading activities are in line with their religious beliefs.

Additionally, easyMarkets Islamic trading offers competitive spreads, free guaranteed stop loss, no slippage, and negative balance protection. It also allows the option of trading in numerous markets including forex, commodities, and indices.

Available Instruments with easyMarkets Islamic Account

easyMarkets broker offers a variety of trading instruments across several financial markets. These include:

- Forex: easyMarkets provides the opportunity to trade a wide range of currency pairs, including major, minor, and exotic pairs. This allows traders to benefit from the fluctuations in the foreign exchange market.

- Shares: Traders can also invest in shares of various well-established companies through easyMarkets. This allows them to participate in the growth and success of the companies they invest in.

- Cryptocurrencies: easyMarkets also enables trading in the most popular digital currencies. This includes Bitcoin, Ethereum, Ripple, and several others. Cryptocurrencies are known for their high volatility, which can potentially lead to significant profits.

- Metals: Investors can also trade in precious metals such as gold, silver, platinum, and palladium. Metals are often considered as safe-haven assets and can provide a hedge against financial market volatility.

- Commodities: With easyMarkets trading, traders can trade in a variety of commodities including oil, natural gas, wheat, corn, and soybeans. Commodity trading can serve as a good way to diversify an investment portfolio.

- Indices: easyMarkets also provides access to some of the world’s most popular indices such as the S&P 500, NASDAQ, and FTSE 100. Trading in indices provides exposure to a broad section of the market and can be a way to mitigate the risks associated with individual stocks.

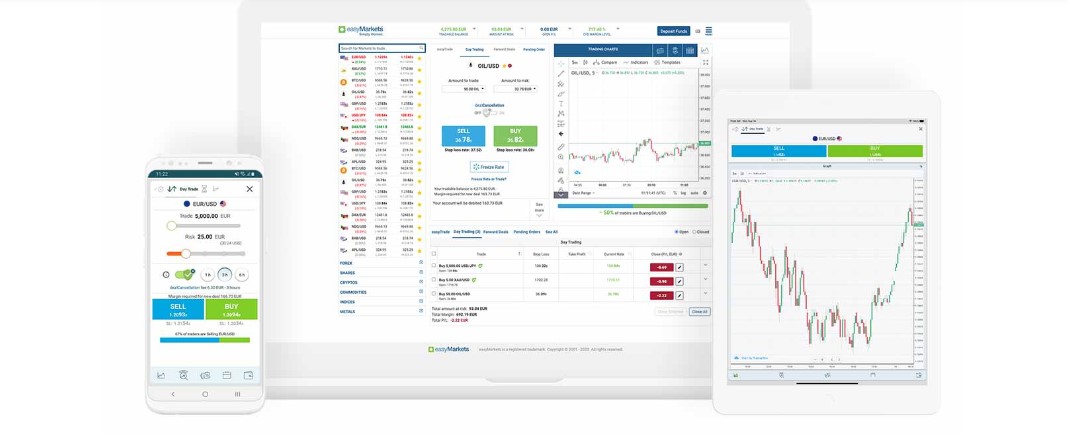

easyMarkets Trading Platforms

easyMarkets is a trading company that offers various platforms for its users to engage in trading activities. Each platform offers different features and capabilities, providing options for traders of all experience levels.

- easyMarkets Trading Platform: This is the primary trading platform provided by easyMarkets. It is user-friendly and offers a wide range of tools and features to assist with trading. It provides real-time rates, charts, and other helpful information for traders.

- easyMarkets Mobile Apps: These are mobile applications that allow users to trade on the go. The apps are designed to be easy to use and offer the same functionality as the main easyMarkets platform. With these apps, traders can monitor the markets, execute trades, and manage their accounts from their smartphones or tablets.

- TradingView: This is a social platform for traders where they can share and discuss trading ideas. easyMarkets platform users can integrate their accounts with TradingView to benefit from its interactive charts and other innovative trading tools. It’s a great platform for both beginner and experienced traders to learn from each other and improve their trading strategies.

- MetaTrader 4: Often referred to as MT4, this is one of the most popular trading platforms in the world. It offers advanced technical analysis tools, automated trading systems, and a customizable trading environment. easyMarkets users can integrate their accounts with MT4 to take advantage of its powerful features.

- MetaTrader 5: This is an upgraded version of MT4, featuring more advanced tools and capabilities. It is designed to provide everything a trader needs, from order placement and management to detailed market analysis. Like MT4, easyMarkets platform users can integrate their accounts with MT5 to maximize their trading potential.

Trading Conditions

- No Slippage: This means that easyMarkets does not allow slippage during trading. Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. It can occur at any time but is most prevalent during periods of higher volatility. It can result in a significant loss for traders. With easyMarkets, the price you see is the price you trade, thus eliminating any risk of slippage.

- Guaranteed Stop Loss: This feature prevents traders from losing more than a certain amount. In other words, it sets a maximum loss that a trader is willing to accept for a trade. If the price of the asset falls to this level, the trade will automatically close, thus preventing further losses.

- No Funding Fees: easyMarkets broker does not charge any fees for deposits or withdrawals. This means that traders can fund their accounts as often as they like without having to worry about incurring any additional costs.

- Negative Balance Protection: This feature protects traders from losing more money than they have deposited in their accounts. If the balance of your account goes into the negative, easyMarkets broker will adjust it to zero free of charge. It is a way of ensuring that traders do not end up owing money to the broker.

Trading Tools

easyMarkets Islamic Account Trading Tools provides a suite of robust tools that are designed to cater to the needs of the Islamic community in online trading. Here is an expansion of these tools:

- Freeze Rate: This tool allows traders to freeze the price they see, giving them a few seconds to decide whether they want to perform a transaction at that specific rate. It helps to eliminate slippage, which can occur in volatile markets. This feature is particularly useful in fast-moving markets where rates can fluctuate rapidly.

- easyTrade: This is a simple and straightforward tool designed to make trading less complex. It has a clearly defined risk and reward from the outset, provides an intuitive and user-friendly interface, and allows trading in both rising and falling markets. easyTrade is suitable for both new and experienced traders.

- dealCancellation: This is a unique tool that gives traders the ability to cancel a losing deal within an hour after opening it, and recover all their losses. This feature can be a lifesaver in volatile markets where prices can move quickly against a trader’s position. It provides an added layer of risk management and helps traders to protect their capital.

These trading tools are all compliant with Islamic law, as the easyMarkets Islamic Account is specifically designed to meet the requirements of Muslim traders, providing a Shariah-compliant trading environment. This means there are no interest charges or hidden fees, and all transactions are executed immediately, thus avoiding any form of monetary speculation.

easyMarkets Deposit Options

EasyMarkets provides its users with various deposit options to make their transactions simpler and more convenient. These options include:

- Credit and Debit cards: Users can use their Visa, MasterCard, or Maestro cards to make deposits. The processing time is usually instant, allowing for immediate trading.

- Bank Wire Transfer: This is a secure method of transferring funds directly from a user’s bank account to their easyMarkets account. The processing time, however, can take up to five business days.

- E-wallet options: These include Skrill, Neteller, and Fasapay. The processing time for these options is also instant.

- Local Bank Transfer: This is another option to make a deposit, with the processing time varying based on the bank and country.

- Union Pay: This is specifically for users in China, with an instant processing time.

- Webmoney: This is a global settlement system and environment for online business activities, with instant processing time.

- SOFORT: This is an online direct payment method and works via online banking. It’s mainly used in countries like Germany, Austria, Netherlands and Belgium.

In terms of fees, easyMarkets does not charge any deposit fees. However, users should be aware that they may incur charges from their bank or e-wallet provider for the transaction. Users are advised to verify their accounts to ensure smooth transactions. This includes providing identification documents and proof of residence. The easyMarkets minimum deposit varies per account type.

It’s important to note that the availability of deposit and withdrawal methods, as well as their processing times and fees, may vary depending on the user’s country of residence. For the most accurate information, users should check the easyMarkets website or contact their customer service.

easyMarkets Withdrawal Options

- Credit/Debit Card: This is the most convenient withdrawal option for most traders. Processing time is usually within a day but may vary depending on the bank. EasyMarkets does not charge any withdrawal fee for this method, but your bank might charge a small transaction fee.

- Bank Wire Transfer: This is another common withdrawal method. The processing time is typically 2-5 business days. EasyMarkets does not charge a withdrawal fee for this method as well, but your bank might charge a fee for the wire transfer.

- E-wallets (like Skrill, Neteller, Webmoney, etc.): These methods are also available for withdrawals. The processing time is usually within 24 hours. EasyMarkets does not charge a withdrawal fee for these services, but the online payment service might charge a small transaction fee.

- Crypto Wallets: EasyMarkets also allows withdrawals to certain crypto wallets. The processing time and fees can vary greatly depending on the specific wallet and the cryptocurrency involved.

Please note that the processing times and fees can vary based on your location, your bank, and the specific withdrawal method. It is always recommended to check with both EasyMarkets and your bank or payment service provider to understand the potential fees and processing times involved. The easyMarkets minimum withdrawal amount also varies with the withdrawal method. For most methods, the minimum withdrawal amount is usually around $50. However, this can be less or more depending on the user’s region and specific withdrawal method.

Education Resources

easyMarkets Education Resources are a comprehensive set of learning tools designed to equip both new and experienced traders with the knowledge they need to succeed in the market. This includes:

- Trading Course: This is a detailed, structured learning program that provides a deep understanding of trading basics, strategies, risk management, and more. It is designed to help traders at all levels improve their trading skills and knowledge.

- Free eBooks: easyMarkets offers a variety of free eBooks that cover a wide range of trading topics. These include introductions to Forex, CFDs, and other markets, as well as more advanced topics like technical analysis and trading psychology.

- Knowledge Base: This is a comprehensive repository of articles, tutorials, and guides that cover every aspect of trading. Whether you’re just getting started or you’re a seasoned trader looking to brush up on your knowledge, the Knowledge Base is an invaluable resource.

- Trading Glossary: This is a comprehensive list of trading terminology, from basic terms like ‘ask price’ and ‘bid price’ to more advanced concepts. This glossary can help traders become familiar with the language of the markets.

- Economic Indicators: These are important statistics that can influence the markets, such as GDP, employment figures, and inflation rates. easyMarkets provides an overview of these indicators, explaining what they are, why they’re important, and how traders can use them.

- FAQs: This section provides answers to frequently asked questions about trading, the markets, and easyMarkets’ services. It’s a quick and easy way to find answers to common queries.

Is easyMarkets Halal in islam?

easyMarkets is considered as Halal in Islam, making it a suitable choice for Muslim traders. It adheres to the principles of Islamic finance, which prohibits any form of usury (interest), gambling, and uncertainty. To ensure their services are in line with Sharia law, easyMarkets offers an Islamic trading account that is interest-free, without any hidden fees or charges, also known as a swap-free account. This means that Muslim traders can engage in online trading without violating their religious beliefs. However, it is always recommended for individuals to consult with a religious scholar to confirm the permissibility of such services according to their personal interpretation of Islamic law.

Is easyMarkets safe?

easyMarkets is a reputable forex broker that prioritizes the safety and security of its clients. Recognized for its transparent trading processes and robust security measures, it ensures a risk-free trading environment for all its users.

easymarkets Review Islamic Account- Conclusion

In conclusion, the easyMarkets Islamic Account is an excellent option for those adhering to the Islamic faith and wanting to engage in forex trading. This account type adheres strictly to the principles of Islamic law, particularly the prohibition of Riba or interest. It offers a swap-free trading experience, meaning overnight positions have no interest charges. Additionally, easyMarkets ensures transparency with no hidden fees or commissions. The user-friendly platform, along with a range of trading instruments, educational resources, and dedicated customer support, make it a favorable choice for Muslim traders. However, it’s essential for potential users to thoroughly understand the specific terms and conditions tied to the use of the Islamic Account.

FAQs

What should you know about easyMarkets?

EasyMarket offers six different asset classes for trading: CFD, Forex, Commodity, Index, Share, and Crypto. You need a minimum $ 100 deposit with easyMarkets. You can sign up for a demo account to familiarize yourself with the EasyMarkets platform. easyMarkets platform is suitable for traders with different experience levels, whether professional or beginner. Check out more Forex brokers with Islamic accounts and their features.

Is EasyMarkets safe?

The broker’s administrative body and regulatory status are essential when choosing EasyMarket. Brokers who conduct business without the supervision of a regulatory body do so at their discretion. As a result, any capital you invest in is at risk.

Established in 2001, headquartered in Cyprus, Australia for over 21 years.

EasyMarket is regulated. This means that EasyMarkets is overseen and monitored by the Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investment Commission (ASIC) regulatory bodies.

Regulated brokers will not manipulate the market price. When you send a withdrawal request to EasyMarkets, it will be honored. EasyMarkets may be stripped of its regulatory status if it violates any regulatory rules.

Is my money safe with EasyMarkets?

Any money paid by traders to EasyMarkets account is kept in a separate bank account.

Uses Tier-1 Bank for EasyMarkets for extra security. Tier 1 is the official measure of a bank’s financial health and strength.

What are Tier 1 banks and why should EasyMarkets use them?

A Tier 1 bank is considered to be the safest and most secure in terms of client capital. Tier 1 actually describes the financial strength of a bank. A Tier 1 bank has strong capital reserves and financial regulators use Tier One banks because they are able to withstand unforeseen financial losses.

What does it mean to have traders funds in EasyMarkets deposited in a Tier 1 bank?

The money you deposit at EasyMarkets means that your funds are kept in a bank where there is sufficient capital to meet your withdrawals even if EasyMarkets closes the business for any reason.

Therefore, all we can safely conclude that EasyMarkets is safe and secure.

That said, please keep in mind that you may lose funds when trading financial assets. For example, accounts can lose money due to not doing enough market research, lack of experience or not using the tools offer by the brokerage platform.

When trading in financial investments, it is not uncommon to lose quick money due to trading CFDs, Forex, Commodities, Indices, Shares, Crypto. Only take risks when you realize that your invested capital is at risk at any time due to market volatility. EasyMarket clearly states on their platform that your capital is at risk.