FundedNext Islamic Account Review

FundedNext has emerged as a prominent player in the prop trading world, providing opportunities for traders to access capital and showcase their skills. They offer a pathway for aspiring traders to manage substantial accounts and earn significant profits. Recognizing the diverse needs of the trading community, FundedNext acknowledges the rising demand for Shariah-compliant trading solutions. More and more Muslim traders seek opportunities that align with their religious beliefs. Let’s find out more about the prop firm in this FundedNext Islamic Account Review.

In response to this growing demand, FundedNext proudly introduces the FundedNext Islamic Account, a meticulously crafted solution designed to adhere to Islamic finance principles. This account allows Muslim traders to engage in FundedNext Forex trading and other markets without compromising their faith. The FundedNext Islamic Account is more than just a trading account; it’s a gateway to ethical and responsible trading, built upon a foundation of transparency and trust.

Islamic finance is rooted in the principles of Shariah law, which prohibits interest-based transactions (riba) and encourages ethical investment practices. When applied to trading, these principles necessitate the creation of specialized accounts that eliminate interest charges and ensure compliance with Islamic guidelines. A key feature of an Islamic trading account is the absence of swap fees, which are interest-based charges applied to positions held overnight. This is a critical element in ensuring that the account adheres to Shariah principles.

To better understand the prohibition of swap fees in Islamic finance, one must delve into the concept of “riba,” which encompasses any form of unjust enrichment derived from lending money. Overnight swap fees involve an interest component, which directly contradicts the core tenets of Islamic finance. Therefore, Islamic trading accounts are designed to operate on a swap-free basis, eliminating any form of interest-based charges. Consequently, traders are able to participate in FundedNext Halal trading without compromising their religious beliefs.

FundedNext Islamic Account Review: Features and Benefits

The FundedNext Islamic Account boasts a range of features and benefits tailored to meet the needs of Muslim traders seeking a Shariah-compliant trading experience. Central to its design is the complete absence of swap fees or interest charges, ensuring that all trading activities remain in accordance with Islamic finance principles. This feature is not merely a technicality; it is a fundamental aspect of the account’s commitment to ethical trading.

Furthermore, the FundedNext Islamic Account provides access to FundedNext’s cutting-edge trading platform and a wealth of resources designed to enhance trading performance. Traders can trade a variety of instruments, including Forex, commodities, and indices, all while adhering to Shariah guidelines. The account’s structure ensures compliance with Islamic finance principles by avoiding interest-based transactions and promoting fair and ethical trading practices. A FundedNext review shows that many Muslim traders value FundedNext Ethical trading principles.

Designed for You: Who Benefits from the FundedNext Islamic Account?

The FundedNext Islamic Account caters specifically to Muslim traders seeking Shariah-compliant trading options. These individuals prioritize adherence to their faith and seek financial opportunities that align with their religious beliefs. The account is also ideal for traders who are generally interested in ethical and responsible trading practices, regardless of their religious background. These traders recognize the importance of aligning their financial activities with their values.

Moreover, the FundedNext Islamic Account appeals to individuals who wish to avoid interest-based transactions altogether. Whether motivated by religious beliefs or ethical considerations, these traders seek alternatives to conventional financial products that involve interest charges. The account provides a viable solution for those who want to participate in the financial markets without compromising their principles. Therefore, traders of all backgrounds can benefit from the ethical and responsible approach of the FundedNext Islamic Account.

Opening Your Account: A Seamless Start to Shariah-Compliant Trading

Opening a FundedNext Islamic Account is a straightforward process designed to be user-friendly and efficient. The first step involves visiting the FundedNext website and navigating to the account registration page. Here, you will find the option to select the Islamic Account type, ensuring that your account is set up in accordance with Shariah principles from the outset.

The registration process requires providing accurate personal information and completing the necessary verification steps. This may include submitting identification documents and proof of address to ensure compliance with regulatory requirements. Once your account is verified, you can deposit funds and begin trading. FundedNext also provides resources and support to help you get started, including tutorials and customer service assistance. By following these simple steps, you can quickly and easily access FundedNext Funding and start trading in a Shariah-compliant manner.

FundedNext Challenge Types

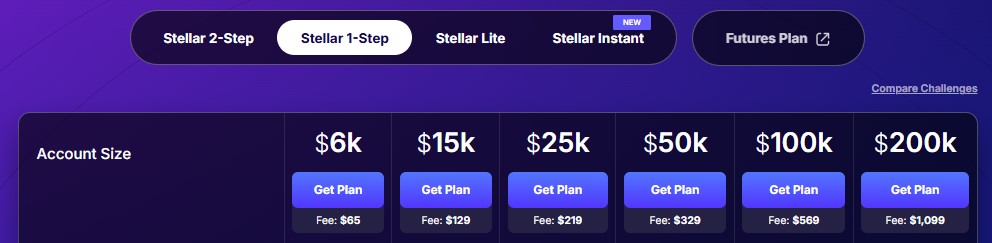

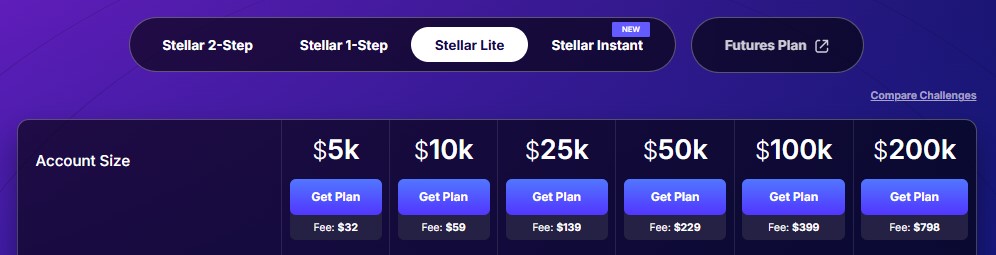

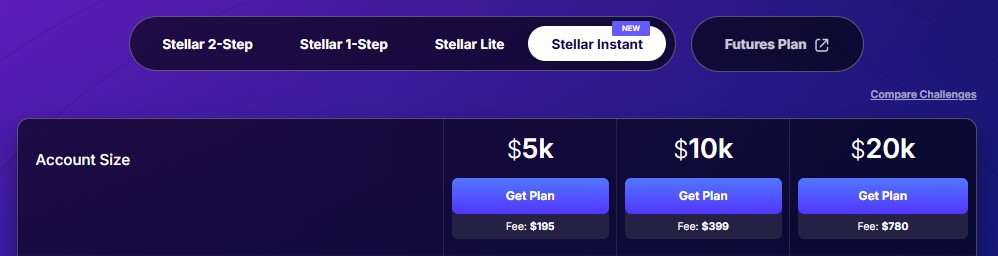

Stellar Account Types (CFDs)

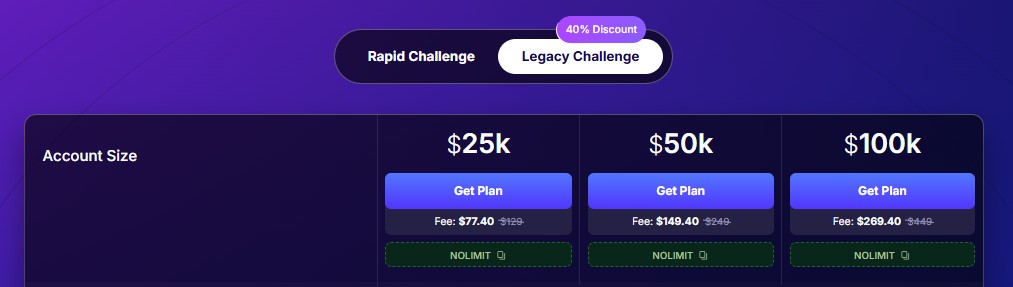

Futures Account Types

Ethical Foundation: FundedNext’s Commitment to Integrity

FundedNext operates on a foundation of strong values and a deep commitment to ethical business practices. The company prioritizes transparency, accountability, and fairness in all its dealings, ensuring that its services align with the highest ethical standards. This commitment extends to its Islamic Account offering, where adherence to Islamic finance principles is paramount.

To ensure compliance with these principles, FundedNext has implemented rigorous processes and controls. These measures include ongoing monitoring of account activity, regular audits, and consultation with Islamic finance experts. FundedNext is dedicated to providing a trading environment that is both ethical and Shariah-compliant by upholding these standards. This dedication gives traders confidence that their activities align with their values. This further solidifies FundedNext’s reputation as a provider of FundedNext Halal trading solutions.

Conclusion: Embrace Ethical Investing with FundedNext

The FundedNext Islamic Account offers a unique opportunity for Muslim traders and those interested in ethical investing to participate in the financial markets without compromising their values. With its commitment to Shariah compliance, transparent practices, and access to advanced trading platforms, the FundedNext Islamic Account stands out as a premier choice for ethical and responsible trading. By choosing FundedNext, traders can align their financial activities with their beliefs.

We encourage you to explore the possibilities of Shariah-compliant trading with FundedNext and experience the peace of mind that comes with knowing your investments are aligned with your values. In an increasingly complex and interconnected world, ethical investing is more important than ever. The FundedNext Islamic Account provides a pathway to financial success while upholding the principles of fairness, transparency, and social responsibility. The FundedNext Swap-free account allows FundedNext Muslim traders to have this ethical trading experience. – FundedNext Islamic Account Review