FundingPips Review

Are you a skilled trader seeking to amplify your capital and unlock new levels of success? The world of proprietary trading firms (prop firms) offers a compelling avenue to achieve this, and FundingPips is emerging as a prominent player in the industry. This FundingPips Prop Trader Review dives deep into the firm’s offerings, assessing its legitimacy, challenge structures, funding options, trading platforms, and more. By the end, you’ll have a comprehensive understanding of whether FundingPips Prop Trading aligns with your trading goals and aspirations.

Proprietary trading, or prop trading, involves trading with a firm’s capital rather than your own. This allows skilled traders to access significantly larger accounts than they might otherwise afford, multiplying their potential profits. FundingPips offers traders the opportunity to manage substantial capital, earning a percentage of the profits they generate. But with numerous prop firms vying for your attention, why consider FundingPips?

FundingPips has quickly gained traction in the prop trading community due to its competitive profit splits, diverse range of account sizes, and commitment to providing traders with a supportive environment. Before committing, it’s crucial to delve into the specifics. This FundingPips Review will help you determine if FundingPips is the right fit, examining everything from their FundingPips Challenge Types to the FundingPips Instruments available for trading.

Separating Fact From Fiction: Is FundingPips Legit?

The first question on any trader’s mind when considering a prop firm is, “Is it legitimate?” With the rise of online scams, it’s essential to conduct thorough due diligence before entrusting any firm with your time and money. So, Is FundingPips legal? Let’s explore FundingPips is legit status.

While FundingPips doesn’t fall under the direct purview of traditional financial regulatory bodies like the SEC or FCA due to the nature of prop trading, the firm’s operational practices and transparency contribute to its perceived legitimacy. User reviews and testimonials, while subjective, can offer valuable insights. A careful review of these, combined with an understanding of FundingPips’s terms and conditions, can help you gauge the firm’s trustworthiness.

Understanding FundingPips Challenge Types

The typical path to becoming a funded trader with FundingPips involves passing a challenge, designed to assess your trading skills and risk management abilities. Understanding the different FundingPips Challenge Types is critical to choosing the program that best suits your trading style and experience level.

FundingPips offers various challenge options, each with its own set of rules, objectives, and fees. These challenges typically involve reaching a specific profit target within a defined timeframe, while adhering to maximum drawdown limits. Some challenges may have multiple phases, requiring consistent profitability to advance. Carefully analyze the rules and objectives of each challenge to determine which one aligns with your risk tolerance and trading strategy. Success in these challenges earns you a FundingPips Account.

FundingPips Challenge Types

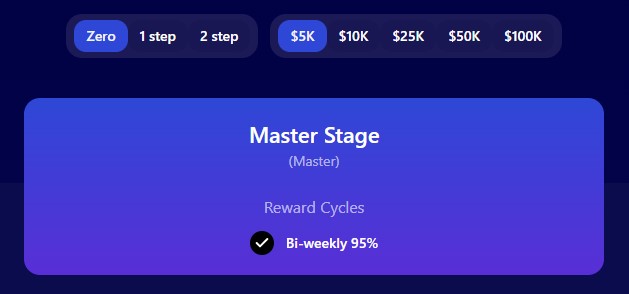

Zero Evaluation

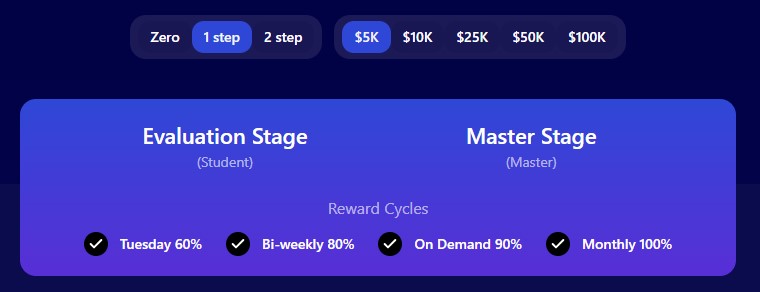

1 Step Evaluation

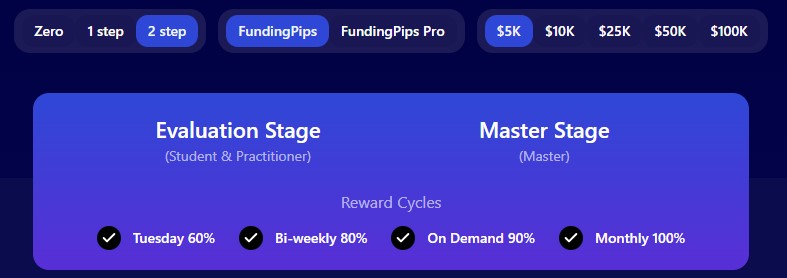

2 Step Evaluation

A Look at FundingPips Instruments and Assets Available

The range of FundingPips Instruments available for trading is a crucial factor to consider when choosing a prop firm. Access to diverse markets allows you to capitalize on various trading opportunities and diversify your portfolio. What FundingPips Assets available for you?

FundingPips typically offers a wide selection of instruments, including:

- Forex Pairs: Major, minor, and exotic currency pairs provide ample opportunities for forex traders.

- Commodities: Trade precious metals like gold and silver, as well as energy products like crude oil.

- Indices: Access global stock market indices such as the S&P 500, Dow Jones, and FTSE 100.

- Cryptocurrencies: Trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Stocks: Access a range of stocks from various global markets.

Power at Your Fingertips: Analyzing FundingPips Trading Platforms

The trading platform is your primary tool for executing trades and managing your account. FundingPips offers access to several popular platforms, each with its own unique features and benefits. The choice of platform can significantly impact your trading experience, so let’s break down the FundingPips Trading Platform options.

FundingPips typically supports:

- MetaTrader 5 (FundingPips MetaTrader 5): A widely used platform known for its advanced charting tools, automated trading capabilities (Expert Advisors), and wide range of technical indicators.

- MetaTrader 4 (FundingPips MetaTrader 4): An older but still popular platform, MT4 is valued for its simplicity and extensive library of custom indicators and EAs.

- cTrader: A platform favored by experienced traders for its depth of market analysis tools, order execution speed, and transparent pricing.

- Match-Trader: A platform renowned for its copy-trading features, allowing users to follow and replicate the strategies of successful traders, as well as its user-friendly interface.

The availability of these platforms provides traders with flexibility and choice. Consider your trading style and platform preferences when making your decision.

Exploring the FundingPips Islamic Account

For traders who adhere to Sharia law, which prohibits interest-based transactions, FundingPips offers a FundingPips Islamic Account. This account type allows traders to participate in prop trading while remaining compliant with their religious beliefs. Does FundingPips offer an Islamic Account? Yes, it does.

An Islamic account, also known as a swap-free account, eliminates overnight interest charges (swaps) on positions held overnight. This is achieved by using alternative methods of compensation that comply with Islamic finance principles. Therefore, FundingPips is halal.

Opening a FundingPips Islamic account typically involves a simple application process. Contact FundingPips’s customer support team for specific details and requirements.

The Final Tally: Is FundingPips the Right Prop Firm for You?

After a thorough examination of FundingPips’s offerings, it’s time to render a verdict. Is FundingPips legal? The answer is, while they are not regulated by traditional financial regulators, their business model and transparency suggest legitimacy. However, it’s vital to weigh the pros and cons before making a decision.

Pros of FundingPips Prop Trading:

- Competitive profit splits

- Diverse range of account sizes

- Multiple challenge types to suit different trading styles

- Availability of instant funding options

- Wide selection of tradable instruments

- Access to popular trading platforms

- Islamic account options

Cons of FundingPips Prop Trading:

- Challenge fees may be non-refundable

- Trading restrictions and drawdown limits apply

- Profit splits are not 100%

Who Should Consider FundingPips?

FundingPips is a suitable option for:

- Experienced traders seeking to leverage their skills with larger capital

- Traders who are disciplined and have a proven track record of profitability

- Individuals who are comfortable with the risks associated with prop trading

- Traders who require Islamic account options

Final Recommendations:

Before committing to FundingPips, carefully review their terms and conditions, understand the risks involved, and consider your own trading goals and risk tolerance. If you’re a skilled and disciplined trader seeking to amplify your potential, FundingPips is a prop firm worth considering.