OANDA PROP TRADER Review

Are you ready to take your trading to the next level? Do you dream of managing substantial capital and maximizing your profit potential? If so, then proprietary trading, or prop trading, might be the path you’ve been searching for. Among the various prop firms vying for your attention, OANDA stands out as a well-established and reputable player. But is it the right fit for you? This OANDA Prop Trader Review dives deep into the offerings of OANDA’s prop trading program, examining its features, benefits, and potential drawbacks to help you make an informed decision.

Prop trading allows you to trade with the firm’s capital, sharing the profits you generate. Instead of risking your own funds, you demonstrate your skills and risk management abilities through a challenge or evaluation phase. Successfully navigating this phase earns you access to funded accounts and a share of the profits. OANDA Prop Trading presents an intriguing option for traders seeking to scale their operations without significant personal financial risk.

OANDA boasts a long-standing reputation in the retail trading space. For years, OANDA has been recognized as a reputable broker, known for its transparent pricing, advanced technology, and regulatory compliance. This established credibility lends weight to its prop trading program, offering traders a sense of security and reliability often sought in the prop trading world. OANDA provides you with a platform to showcase your skills and potentially manage significant capital, while also providing you with resources to grow and succeed.

Is OANDA Legit? Navigating the Landscape of Trust

One of the most critical questions any aspiring prop trader asks is: “Is OANDA legal?” or “OANDA is legit?”. The answer to both is reassuringly yes. OANDA operates under the watchful eyes of multiple regulatory bodies across different jurisdictions. This rigorous oversight ensures that OANDA adheres to strict financial standards and protects its traders’ interests.

Beyond regulatory compliance, user reviews and testimonials offer valuable insights into a company’s trustworthiness. While individual experiences may vary, a general consensus emerges from online forums and review sites regarding OANDA’s reliability. Traders often praise OANDA’s transparent pricing, the robust OANDA Trading Platform (OANDA MetaTrader 5 (OANDA MT5)), and responsive customer support. This positive sentiment reinforces the notion that OANDA is a reputable and trustworthy prop firm.

Embarking on Your Journey: Understanding OANDA Challenge Types

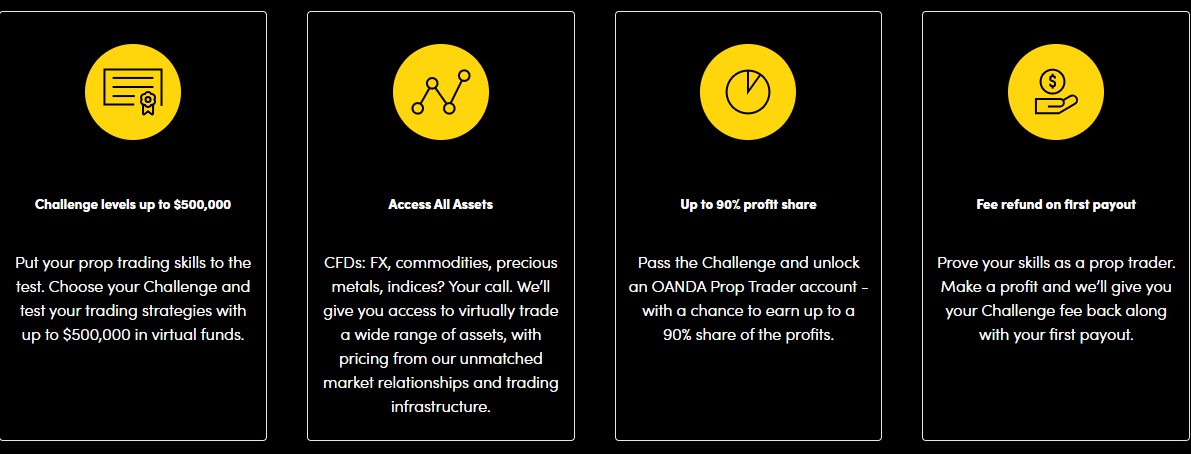

To gain access to funded accounts, you’ll need to successfully complete a challenge. OANDA offers various OANDA Challenge Types, each with its own set of rules, objectives, and fees. Understanding these different challenges is crucial for selecting the one that best aligns with your trading style and risk tolerance. OANDA has several challenge options, allowing you to find one that suits your risk level and trading preference.

Trailing Drawdown (Classic Challenge):

– $5K for $35

– $10K for $60

– $25K for $199

– $50K for $299

– $100K for $599

– $188K for $888

– $250K for $1,200

– $500K for $2,400

Static Drawdown (Boost Challenge):

– $10k for $99

– $50K for $399

– $100K for $699

A World of Opportunities: OANDA Instruments and Assets Available

One of the key advantages of trading with OANDA is the wide range of OANDA Instruments and OANDA Assets Available. You can diversify your portfolio and capitalize on opportunities across various markets. Whether you prefer the fast-paced world of forex or the stability of commodities, OANDA offers a diverse selection of instruments to suit your trading style.

OANDA provides access to a comprehensive selection of Forex Pairs, including major, minor, and exotic currencies. For commodity traders, OANDA offers a range of commodities, including precious metals like gold and silver, as well as energy products like crude oil. Additionally, you can trade Indices, representing the performance of specific stock markets, and even explore the volatile world of Cryptocurrencies. Finally, OANDA might offer access to Stocks, allowing you to invest in individual companies. This diverse range of instruments and assets empowers you to create a well-rounded portfolio and capitalize on opportunities across various markets.

OANDA Trading Platform – OANDA MetaTrader 5

The OANDA Trading Platform – OANDA MetaTrader 5 (OANDA MT5) is a powerful and versatile platform designed to meet the needs of both novice and experienced traders. Features and Benefits of OANDA MT5 are extensive. With advanced charting tools, technical indicators, and automated trading capabilities, OANDA MetaTrader 5 provides you with the resources you need to analyze the markets and execute your trades with precision.

Furthermore, Customization and Usability are key strengths of the OANDA MetaTrader 5 platform. You can customize the platform to suit your individual preferences, creating a personalized trading environment. The user-friendly interface makes it easy to navigate the platform and access the tools and features you need. Whether you prefer manual trading or automated strategies, OANDA MT5 provides a robust and reliable platform for executing your trades.

Inclusivity Matters: OANDA Prop Trader Islamic Account

For traders adhering to Sharia law, OANDA offers the OANDA Prop Trader Islamic Account. This account type is designed to comply with Islamic finance principles, specifically prohibiting the charging or payment of interest (riba). What is an Islamic Account? It’s a trading account that adheres to Sharia law.

The Features and Benefits of OANDA’s Islamic Account include swap-free trading, meaning you won’t be charged or credited interest on overnight positions. This allows you to trade in accordance with your religious beliefs without incurring any prohibited charges. How to Open an Islamic Account typically involves completing a specific application form and providing documentation to verify your religious affiliation. OANDA’s commitment to inclusivity ensures that traders from all backgrounds can participate in the prop trading program. OANDA acknowledges the importance of adhering to different religious principles and provides an account that aligns with those beliefs. As such, the question of “OANDA is halal?” can be answered with yes, for those who choose the Islamic Account option.

Final Thoughts: Is OANDA the Ideal Prop Firm for You?

Choosing the right prop firm is a crucial decision that can significantly impact your trading career. OANDA offers a compelling proposition with its established reputation, regulatory compliance, diverse range of instruments, and powerful trading platform. However, it’s essential to weigh the Pros and Cons of OANDA Prop Trading before making your final decision.

Who Should Consider OANDA? OANDA may be a good fit for traders who value transparency, reliability, and a wide range of trading instruments. If you’re seeking a prop firm with a solid track record and a commitment to regulatory compliance, OANDA is worth considering.

Ultimately, the best prop firm for you depends on your individual needs, preferences, and trading goals. OANDA is a worthy contender in the prop trading space, offering a blend of stability, opportunity, and innovation. By carefully evaluating your options and considering the factors discussed in this OANDA Review, you can confidently choose the prop firm that will help you achieve your trading aspirations. The Final Recommendations are to research, compare, and consider if OANDA’s offerings meet your requirements as a trader.