QT | Funded Islamic Account Review

In the realm of online trading, the demand for Shariah-compliant options is steadily rising, especially among Muslim traders who seek to align their investment activities with their religious beliefs. QT Funded has emerged as a player in this niche, offering what it calls an Islamic Account designed to adhere to Islamic finance principles. This review provides an unbiased evaluation of the QT Funded Islamic Account, exploring its features, benefits, and potential drawbacks to help you make an informed decision.

Islamic finance operates on a foundation of principles distinct from conventional finance, most notably the prohibition of interest (riba). This prohibition extends to trading accounts, where the accumulation of interest through overnight holding fees (swaps) is a common practice. An Islamic trading account, therefore, must be structured to avoid interest-based transactions.

Key features of an Islamic account typically include the absence of swap fees, adherence to Shariah law through specific operational guidelines, and investment options that align with ethical considerations. These accounts often exclude investments in industries deemed non-halal, such as alcohol, gambling, or weapons manufacturing. The goal is to provide a trading environment that is both profitable and morally sound for Muslim traders.

QT Funded: A Gateway to Funded Trading

QT Funded is a proprietary trading firm that provides traders with capital to trade the financial markets. They offer various account types and challenges that traders can undertake to prove their skills and gain access to funded accounts. The firm supports trading in a range of instruments, including Forex, commodities, and CFDs, through popular trading platforms.

With QT Funded, traders can access various funding options, and demonstrate their skills through challenge programs to become funded traders. This structure allows individuals to trade with larger capital allocations than they might otherwise have access to. This can significantly amplify potential profits, making QT Funded an attractive option for skilled traders looking to scale their operations.

Unveiling the Features of the QT Funded Islamic Account

The QT Funded Islamic Account is tailored to meet the requirements of Shariah-compliant trading. Here’s a breakdown of its key features:

- QT Funded No swap fees: A cornerstone of the QT Funded Islamic Account is the absence of swap fees. Instead of charging interest for overnight positions, QT Funded structures its Islamic accounts to eliminate this element, ensuring compliance with Islamic finance principles.

- QT Funded Shariah-compliant trading: QT Funded asserts that its Islamic Account adheres to Islamic principles by avoiding interest and non-permissible investments. The company may have obtained certifications or endorsements from Islamic scholars to further validate its Shariah compliance.

- Trading Instruments: Through the QT Funded Islamic Account, traders can access a range of Forex pairs, commodities, and other CFDs (Contracts for Difference). This allows for diversification and the ability to capitalize on various market opportunities while adhering to Islamic finance guidelines.

- Leverage: Leverage is a double-edged sword. The QT Funded Islamic Account offers leverage, allowing traders to control larger positions with a smaller amount of capital. While this can magnify profits, it also amplifies potential losses, requiring careful risk management.

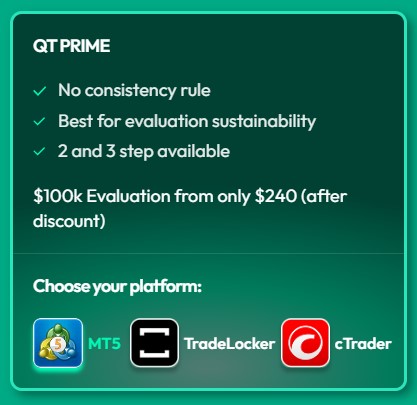

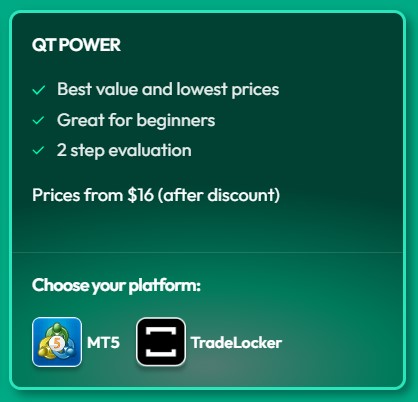

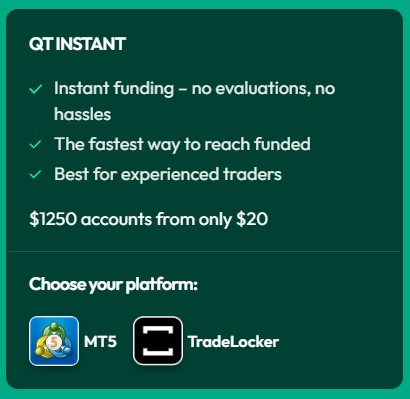

- QT Funded Accounts (QT Funded Challenge Types): QT Funded offers a variety of account types and challenge options for its Islamic account holders. These variations may include different funding levels, profit-sharing ratios, and risk parameters, allowing traders to choose an option that aligns with their individual preferences and risk tolerance.

Weighing the Pros and Cons of the QT Funded Islamic Account

Pros:

- Shariah Compliance: The primary advantage is adherence to Islamic finance principles, making it suitable for Muslim traders seeking ethical investment options.

- No Swap Fees: The absence of swap fees eliminates a significant source of prohibited interest, aligning with Islamic finance requirements.

- Access to a Variety of Trading Instruments: Traders can diversify their portfolios with a range of Forex pairs, commodities, and CFDs.

- Reputable Platform: QT Funded aims to provide a reliable platform for traders, offering access to trading tools and resources.

Cons:

- Limited Availability: Islamic accounts may not be available in all regions or to all clients, potentially restricting access for some traders.

- Higher Fees Compared to Standard Accounts: In some cases, Islamic accounts may have higher fees or commissions compared to standard accounts to offset the absence of swap fees.

- Specific Trading Restrictions: Certain trading strategies or instruments may be restricted to ensure compliance with Islamic principles.

QT Funded Islamic Account Review: Is QT Funded Halal?

Whether QT Funded is considered Halal depends on individual interpretations and adherence to Islamic principles. The availability of an Islamic account, the absence of swap fees, and the avoidance of non-halal investments are all positive indicators. However, it’s crucial for traders to conduct their own due diligence and consult with religious advisors to determine if QT Funded aligns with their personal beliefs.

Conclusion: Is the QT Funded Islamic Account Right for You?

In conclusion, the QT Funded Islamic Account offers a Shariah-compliant trading solution for Muslim traders seeking to participate in the financial markets. With its no swap fees, access to various trading instruments, and adherence to Islamic finance principles, it presents a viable option for ethical trading.

However, it’s essential to carefully consider the potential drawbacks, such as limited availability, higher fees compared to standard accounts, and specific trading restrictions. Before making a decision, conduct thorough research, compare the QT Funded Islamic Account with other offerings, and consider your individual needs and preferences.